Okay, interest rates are going up and inflation is chipping away at our paychecks. Gasoline is at an all time high, which has inflated, well, the inflation rate. My dad use to say, “when they raise gas prices, that is money right out of my pocket.” The factual dissertation I gave you is not the year 2022. It is circa late 1960’s and 1970’s.

Americans don’t want to know ‘why,’ but ‘who,’ is responsible for their misery; the misery index. It is easy to blame the boss. The man elected to the highest office in the land. I am talking about the President of the United States. But, is the President a scapegoat, a sacrificial lamb to be offered to the people for their economic misery? Jimmy Carter and George H.W. Bush could give us an “Amen” regarding the economy and their political misfortune. But were they actually responsible?

The misery index is very simple to calculate. It is the unemployment rate added to the inflation rate. It is assumed that the higher rate of unemployment and a worsening of inflation creates economic and social costs for any given country. A combination of rising inflation and more people out of work implies a deterioration in economic performance and a rise in the misery index. The highest, lowest, and current level of the misery index are listed below:

- High – 21.98 in June 1980 (President Carters last year in office);

- Low – 2.97 in 1953 (President Eisenhower was in office, World War II had ended); and

- Current – 11.86 in 2022 (President Biden’s first year in office, amid controlling the COVID epidemic).

Enter the Federal Reserve System1

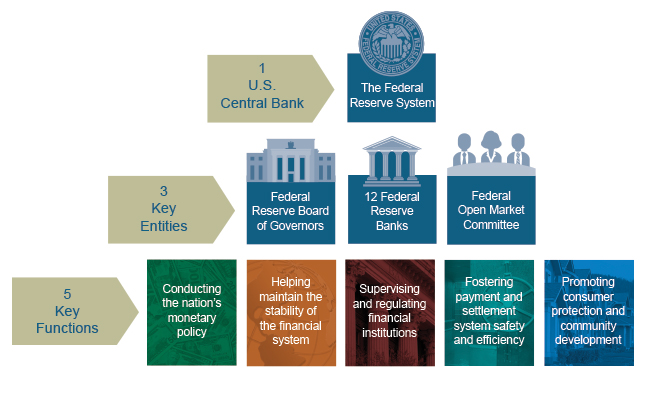

The Federal Reserve System (FRS) is the central bank of the United States. There are 12 Federal Reserve Banks. All of this is overseen by the Federal Reserve Board (FRB). Currently, there are six FRB members. The FRB should consist of seven members, however, one member has yet to be confirmed by the U.S. Senate. The members of the FRB are called, Governors. Each Governor is nominated by the President and confirmed by the Senate. They serve 14 year terms and cannot be re-nominated.

On top of the FRB are the Chairman and Vice Chairman. The Chairman and Vice Chairman are also nominated by the President and confirmed by the Senate. However, they serve four year terms and can be re-nominated by the President. The term is always expires in the middle of a presidential term. This is a further attempt to make the FRB and the FRS, overall, apolitical.

The longest serving FRB Chairman was William McChesney Martin. He served from 1951 to 1970. Alan Greenspan, the creator of irrational exuberance, is the second longest serving Chairman, from August 11, 1987 to January 31, 2006. The current Chairman of the Federal Reserve Board is Jerome Powell.

The Federal Reserve System performs five general functions. These functions are noted in the outline of the Federal Reserve System below:

As you can see, the Federal Reserve System’s 3 Key Entities operate independently of each other and are equal in authority and power. When the Board of Governors meet, they each have a vote in monetary policy, stability of the financial system, supervising and regulating financial institutions, and promoting consumer protection and community development.

In order to understand inflation, one must have an overview of the Federal Reserve System. So, who is to blame for our current economic predicament: the FRS or the Biden Administration?

Who is to Blame?

I once had an economic professor who asked the class, “could you imagine if you could get tomorrow’s newspaper today?” You could avoid the uncertainty of the market and the economy.

In 2021, President Biden took office. The Democratic Party took control of both Houses of Congress, although by a slim majority in the Senate. In this transition of power, we saw an ideological shift of priorities as well: away from tax cuts favored by the Republicans toward expansive new social programs.

History is a teacher. When problems are confronted, we look to the past and see ‘how it was done.’ But we must consider the United States, and even the World, had nothing in its past to deal with the economic impact of COVID-19. As a result of the global pandemic, economies turned out to be so different from anything we experienced. COVID undercut supply, which resulted in shortages of raw materials, container ships, workers, computer chips and so much more.

Advisors to both President Biden and the Federal Reserve Board warned that economic restrictions from the pandemic would bring: weak demand, slow growth, long periods of high unemployment and too low inflation. These factors were all seen in the economic downturn from 2007 – 2009. Looking at the economic crisis of 2007 – 2009, the Federal Reserve Board continued with the low-interest-rate policies that it believed had been effective in combating the crisis.

In order to regulate the economy, the President (with approval from Congress) can do several things: cut taxes, spend money on infrastructure projects (job creation bills), or pass federal relief to include a stimulus for Americans. In 2020, as a direct result of COVID, President Trump signed off on a $3 trillion relief and stimulus package. The bill had bi-partisan support in Congress. When Biden became President, he agreed to a $1.9 trillion plan. The plan included: $300 a week in extra unemployment benefits through September 2021, $1,400 relief checks to those Americans who meet the criteria, and an addition to $600 passed by Congress in December 2020.

Many economists believed that the stimulus packages passed by both Trump and Biden would lead to inflation. When the stimulus checks were passed by Congress, monthly household income was approximately $25 billion to $30 billion below what it would be in a normally functioning economy. However, because of COVID, the economy was not normal. Many workers were out of work because of COVID, mainly in the service industries like restaurants, hotels, air travel, etc. However, projections by these same economists believed the stimulus was too much. The money given to Americans was near $200 billion a month in household income. While some economists believed the stimulus money would “fill the output gap,” others believed the stimulus packages would spike inflation. In other words, Americans had too much money to spend, a very low interest rate, and this would cause inflation to spiral upward.

The Federal Reserve Board can also do several things to regulate the economy. Two main tools the Federal Reserve Board has at its disposal includes: moving the interest rate up or down and buying or selling bonds. As a result of COVID, the Federal Reserve Board moved interest rates to near zero and bought bonds. (When the Federal Reserve Board buys bonds, they are putting money in the economy. In theory, this helps stimulate the economy).

So, while Americans were receiving a nice size stimulus check and those who were unemployed an additional $300 per week in unemployment benefits, the Federal Reserve Board decided to keep interest rates low. It was the perfect storm for an already overheated economy. President Biden decided to keep Jerome Powell as Federal Reserve Chairman. The Senate also agreed and Powell has been renominated to another four year term.

Inflation began to surge in June 2021. The Federal Reserve Board sent a message to President Biden and the American people, “inflation was transitory. They based their ‘transitory projection’ on a low unemployment rate at 5.9%. In November 2021, the Federal Reserve was adding more stimulus by purchasing $120 billion of Treasury and mortgage backed bonds per month. The Federal Reserve’s plan was to cut back on the monthly purchases of bond to zero before they began to raise interest rates.

The Culprit Is?

As you can see, it is hard to lay blame on the current inflation rate. The Federal Reserve Board did what it thought was the right thing. They held down interest rates to keep the economy moving. The problem arose when they did not know ‘when’ to raise interest rates. Chairman Powell said, “If you look back in hindsight then, yes, it probably would’ve been better to have raised interest rates earlier.”

President Trump and Biden provided stimulus money that overheated the economy. Or did it? The stimulus packages did drive unemployment down quickly below 4%, which many economist believe helped the United States economy recover faster from the COVID economic crisis. However, when the Biden administration saw inflation on the rise, was it wrong to release additional stimulus money? Treasury Secretary, Janet Yellen, admitted to Congress in a hearing, specifically on inflation, that she and other officials erred in believing higher inflation would be transitory.

So there you have it. The American economic system is very complex. It has many pieces and people coming together in an attempt to achieve maximum bargaining power for the American dollar. When the economy does go ‘south,’ it is almost impossible to determine the cause, let alone ‘who’ caused it. Unless, as my college economic professor once asked, “what would happen if we could get tomorrow’s newspaper today?”

Endnote:

- Federal Reserve System.gov.

Leave a Reply