On November 15, 2021, President Joseph Biden signed into law a $1 Trillion infrastructure plan, the first part of his economic legislative agenda. What exactly is in this massive spending bill? Before we approach the inventory of this legislation, let’s see who supported it. In August 2021, the U.S. Senate passed the bill by 69 to 30. That means 32 Republicans voted for this legislation. In November 2021, the U.S. House passed the bill by a narrower margin of 228 to 206. So this means, 13 Republicans supported the bill, sending it to the President for signature.

Part 1: Infrastructure Bill – What’s Inside This Historic Bill

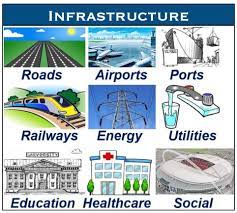

The new law will reach almost every corner of the country. It is a historic investment that can be compared to building the transcontinental railroad, the Interstate Highway System, and Roosevelt’s New Deal. Let’s break it down:

Roads and Bridges

The bill provides $110 billion to repair aging highways, bridges, and roads. It will dedicate $40 billion for new bridges. This makes it the largest bridge building project since the construction of the national highway system, according to the Administration.

Public Transit

There is $39 billion in this legislation that will expand the transportation system, improve accessibility for people with disabilities. Also, it will provide state and local governments funding to buy zero-emission and low-emission buses.

Passenger and Freight Rail

In an effort to reduce Amtrak’s maintenance backlog, the bill provides Amtrak $66 billion. The funds are needed to improve the rail service’s Northeast Corridor as well as other routes. President Biden originally asked for $80 billion. The funds will be the largest federal investment in passenger service since Amtrak was founded 50 years ago.

Modernizing the Electric Grid

The legislation will provide $65 billion in an effort to improve the reliability and also the resiliency of the Nation’s power grids. This comes on the heals of increasing power outages across the country. It will also increase carbon capture technologies and attempt to provide more environmentally friendly electricity such as hydrogen.

Airports

To improve runways, gates, and taxiways at the Nation’s airports, the bill provides $25 billion. It will also improve air traffic control towers which are in need of upgrades.

Water and Wastewater

The legislation provides $55 billion for water and wastewater infrastructure. Included in this section of the bill is $15 billion to replace lead pipes and $10 billion to strictly address water contamination.

Internet Access

In an attempt to improve internet services for rural areas, low-income families, and tribal communities, the legislation will provide $65 billion. The funds for this broadband access will be made available through grants directly to the states.

Electric Vehicles

One of the biggest hinderances for electric vehicles are the lack of charging stations. The bill will provide $7.5 billion for vehicle charging stations. Also, the bill will provide $5 billion for electric school buses and hybrids. This is an attempt to reduce the reliance on school buses that burn diesel fuel.

Part 2: The Build Back Better Act

The cost of the Build Back Better Act has been whittled down from its original $3.5 trillion price tag to $1.75 trillion over a decade. Since there is little, if no, Republican support, the passage of the legislation is not guaranteed. The bill is also called the social spending bill because of what it offers. Let’s take a look:

Climate Change

Slowing the rate at which Earth warms will mean transitioning away from fossil fuels, the major source of greenhouse gas emissions. The new framework unveiled by the White House contains $555 billion for climate and clean energy investments.

Child care and Universal Pre-K

President Biden’s plan includes $400 billion for child care and preschool through programs funded for six years. It expands access to universal preschool for all 3 and 4 year olds, and also limits child care costs for some families to no more than 7% of income.

Medicare Expansion

This is the most heavily debated provision of the Bill. Primarily, it would expand Medicare to cover hearing services. However, the Senate eliminated a proposal for Medicare to also include dental and vision benefits. This was a key priority for Senator Bernie Sanders.

Extended Child Tax Credit

President Biden’s bill would extend the child tax credit for one year, for 2022. The White House opines this will provide more than 35 million households up to $3,600 in tax cuts per child. Under the Act, families receive $3,600 per child under age 6, and $3,000 per child ages 6 to 18. Most families receive monthly payments of either $250 or $300 per child.

Housing, Health Care and Immigration Provisions

President Biden’s legislation includes $150 billion to build or improve more than 1 million new affording housing units and help with rental and down payment assistance.

In reference to health care, the plan would lower premiums by an average of $600 per person for more than 9 million Americans who purchase insurance through the Affordable Care Act’s marketplace. It would also provide coverage for up to 4 million Americans who are currently uninsured.

The Act includes an additional $100 billion to reform the nation’s immigration system. If this is included, it would raise the price tag of the from $1.75 trillion to $1.85 trillion.

How to Pay for the Build Back Better Act

Under President Biden’s legislation, a 15% minimum tax would be imposed on corporate profits that large corporations report to shareholders, as well as a 1% surcharge on corporate stock buybacks. The White House opines that those provisions would raise $450 billion in new revenue.

The bill also calls for a global minimum tax and new surtax on the wealthiest Americans’ income. The Bill plans to increase IRS workers in an effort to bolstered IRS enforcement; therefore, increasing revenue. The bill would impose a 5% tax rate above those with an income over $10 million, and another 3% surtax on income over $25 million. The White House estimates the new surtax would raise an additional $230 billion from the nation’s highest earning taxpayers. According to the White Hose, the total new revenue under the proposal would total nearly $2 trillion.

It is unknown if President Biden can pass the Build Back Better economic plan. Republicans believe too much is being spent; placing America further in debt. Meanwhile, the Democrats feel they must pass this part of the Administration’s economic agenda, without it, the Infrastructure Bill may mean little to the American voters.

Leave a Reply