There Goes the Economy

There is little doubt that historians will look at COVID as being a historic event which shaped and changed our world. From masks to social distancing and finally vaccination, COVID stands to be the single most significant event in the first half of the 21st Century. Economists know all too well when such events occur the economy goes with it.

Two Economic Indicators

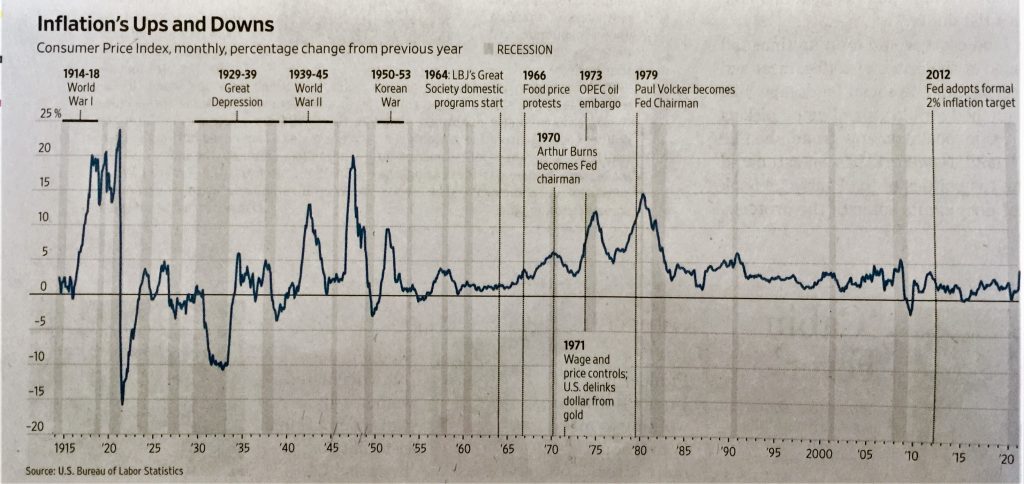

In determining the overall strength of an economy, economists look at many “economic indicators.” Two of the best economic indicators used to determine the economic strength of a country are the Consumer Price Index (CPI) and inflation. The CPI is “a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.”1 Inflation is “the decline of a given currency’s purchasing power over time; or, alternatively, a general rise in prices.”2

How is inflation and CPI related? Inflation is an increase in the overall price level. The official inflation rate is tracked by calculating changes in the CPI. The graph below depicts a comprehensive year to year time table of changes in the consumer price index (CPI), major political events, and recessions (note recessions are marked in grey) from 1915 to 2020. (source: Wall Street Journal)6

How does it all work? Say for example we live in an economy of just oranges. We do nothing but produce and consume oranges. You earn $1 per day and one orange cost almost $1. Now, all of a sudden you receive an extra $1 in your paycheck. You are now willing to bid up the price of an orange. You might be willing to pay $1.50 for an orange. So, what happens? The purchasing power of $1. decreases. The cost of oranges will eventually increase. That is inflation. The CPI of that particular good, in this case oranges, increased by 50%.

What causes inflation? Economist will say that some precipitating event occurs to cause a rise in inflation. If we look at the graph once again, wars almost always have an impact on inflation, or, a major piece of legislation like the start of LBJ’s Great Society program. Let’s move on to 2020 and COVID.

The Federal Reserve Bank (the Feds) and Inflation

As the world struggles to move into a post-COVID economy, the economy appears to be booming. So, why is inflation approaching levels not seen since the late 1960’s and 1970’s? The annual inflation rate in the U.S. edged up to a 13-year high of 5.4% in September 2021 from 5.3% in August 2021.

On or about June 22, 2021, Federal Reserve Chairman Jerome Powell (Mr. Powell) spoke of America’s post-COVID economy and inflation. He stated, “If you look behind the headline and look at the categories where these prices are really going up, you’ll see that it tends to be areas that are directly affected by the reopening…We’re digging out of a very deep hole…We’ve made a lot of progress but we have a long way to go.”5

“We’ve made a lot of progress but we have a long way to go.” Federal Reserve Chairman, Jerome Powell.5

Mr. Powell continued to say it was unlikely inflation would reach double digits like in the 1970’s because the Federal Reserve Central Bank, “is strongly prepared to use its tools to keep us around 2% inflation.”5

The tools Mr. Powell speaks of to slow down inflation consist of raising interest rates or reducing bond purchases. In each scenario, the Central Bank is reducing the money supply in anticipation of slowing down the economy and therefore reducing inflation. The tools possessed by the Feds are ingrained within the U.S.’s monetary and fiscal policies.

That was June 2021 and the inflation rate was about 2%. In late August 2021, Mr. Powell reported price increases would decline. He based his reasoning on the fact that the pandemic would end. Furthermore, any supply-demand imbalances associated with the pandemic would ease back the inflation rate to the Federal Reserve’s 2% goal. Remember in September 2021, the inflation rate was 5.4%.

So, why does inflation continue to haunt the U.S. economic recovery from COVID? Let us take a look at some factors.

Post-COVID and Inflation

Economists are predicting an inflation rate of 5.25% in December 2021. They further predict inflation will be a major factor in the U.S. economy into the 2022 fiscal calendar.

Michael Moran, chief economist at Daiwa Capital Markets America identified three factors which maybe causing a surge in inflation post-COVID; supply-chain bottlenecks, tight labor markets (Help Wanted), ultra-easy monetary and fiscal policies (specifically, lower interest rates). According to Mr. Moran, this is “the perfect storm.”4

When economist look at the COVID pandemic and how it affected the economy, there is no doubt they will report that supply-chain bottlenecks increased prices and affected production. If I am building motor vehicles and have everything I need to assemble the vehicle, I can put the vehicle on the market. However, if I lack one item in my assembly line because another manufacture cannot produce the part fast enough, my automobiles will not go to market. So, the few automobiles I do sell, will have to be sold at an increase price. Therefore, inflation hits the automobile industry.

But what about products that consumers need to buy in order to live or make life easier; food, gas, OTC medicine, toilet paper, cleaning supplies, etc. These are called staple goods. They are generally inexpensive. However, they are not immune to inflation.

Carol Ryan, staff writer for the Wall Street Journal, addressed the price increase in staple goods. He reported, “As a rule of thumb, price increases above 5% are harder to implement without changing buying patterns, according to supermarket and consumer goods executives.”3

What is affecting the inflation rate of staple goods? Albertsons’, Chief Executive Officer Vivek Sankaran stated in an interview with the Wall Street Journal, “On any given day, something is out of stock.”1 Albertsons has had to increase the price of its goods to make up for higher supply-chain and labor costs. However, Mr. Sankaran reported, “We have not seen material change in customer behavior.”1 Therefore, demand for goods continues to drive inflation.

Now what about the Fed’s ultra-easy monetary and fiscal policies? For a longer than anticipated, the Federal Reserve has kept interest rates near zero. The Federal Reserve has already indicated, as seen from the minutes of their September 2021 meeting, that interest rates might need to rise from near zero by the end of next year.

Fed officials are often balancing two risks. When the Feds implement monetary policy, it works with a lag to cool demand. For example, they don’t want to slow the economy at the same moment that supply bottlenecks have abated, because more workers have returned to the labor force. This could lead to undesirably slow growth and inflation.

Constance Hunter, chief economist at KPMG, sums up the economic outlook for next year. “2022 is going to be a perplexing year in many regards.” She predicts growth will be strong but, “it is going to be hard for businesses and consumers to manage through this period of higher prices.”4

Notes:

- Defined by the U.S. Bureau of Labor Statistics.

- Defined by the International Monetary Fund (IMF).

Resources:

- https://www.wsj.com/articles/albertsons-posts-higher-sales-lifts-guidance-dividend-despite-supply-chain-costs-11634562952

- https://www.wsj.com/articles/fed-prepares-to-taper-stimulus-amid-more-doubts-on-inflation-11635154202

- https://www.wsj.com/articles/inflation-is-approaching-a-tipping-point-at-the-grocery-store-11634730128

- https://www.wsj.com/articles/supply-chain-bottlenecks-elevated-inflation-to-last-well-into-next-year-survey-finds-11634479202

- https://www.wsj.com/articles/feds-powell-set-to-testify-before-lawmakers-on-pandemic-programs-11624370400

- https://www.wsj.com/articles/when-americans-took-to-the-streets-over-inflation-11623412801

Leave a Reply